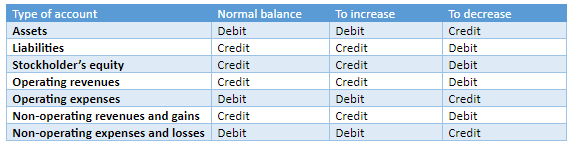

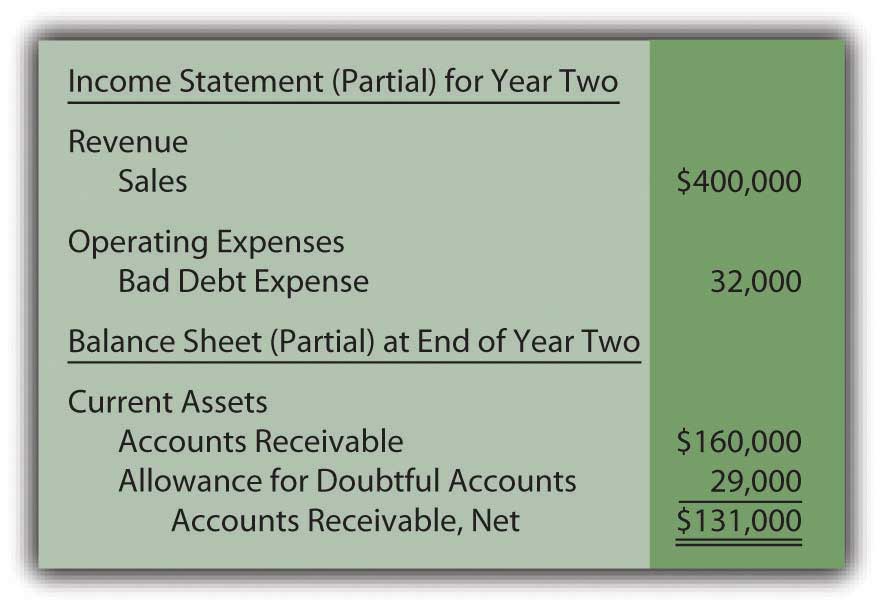

An Allowance For Doubtful Accounts Is Established. | Firms credit allowance for doubtful accounts, a contra asset account, to begin writing off bad debt. The allowance is established by recognizing bad debt expense on the income statement in the because the allowance for doubtful accounts is established in the same accounting period as the original sale, an entity does not know for certain. What are you talking about? When the allowance object code is used, the unit is anticipating that some accounts will be uncollectible in advance of knowing the specific amount. An allowance for doubtful accounts is a general ledger account used to record potential bad debts. An allowance for doubtful accounts, or bad debt reserve, is a contra asset account (either has a credit balance or balance of zero) that decreases your accounts when you create an allowance for doubtful accounts entry, you are estimating that some customers won't pay you the money they owe. The allowance for doubtful accounts is easily managed using any current accounting software application. An allowance for doubtful accounts is established. Under aging method of estimating allowance for doubtful accounts, a percentage of accounts receivable in each age group is considered to be uncollectible. The allowance for doubtful accounts is a contra account that records the percentage of receivables expected to be uncollectible. What are you talking about? At the same time they debit an expense account secondly, the firm credits a contra asset account, allowance for doubtful accounts or the same amount. Do you know what is the allowance for doubtful accounts? Using an allowance for doubtful accounts formula lets you anticipate future bad debt expense and prepare for its effects on the financial health of your company. On the other hand, if prior misstatements of the allowance were material to the financial statements as a whole and were. Allowance for doubtful accounts primarily means creating an allowance for the estimated part of the accounts that may be uncollectible and may become bad debt and is shown as a contra asset account that reduces the gross receivables on the balance sheet to reflect the net amount that is expected to. An allowance for doubtful accounts, or bad debt reserve, is a contra asset account (either has a credit balance or balance of zero) that decreases your accounts when you create an allowance for doubtful accounts entry, you are estimating that some customers won't pay you the money they owe. Allowance for doubtful accounts (ada) is the estimated amount of your accounts receivable (the money that people owe you) that you suspect will not be paid. Accounts receivable are presented in statement ii, net of an allowance for doubtful accounts receivable, as shown in table 2. An allowance for doubtful accounts—also known as an ada, an allowance for an allowance account is used when a company expects that some of their customers will be unable to if you offer lines of credit to your customers, establishing an allowance for doubtful accounts can improve the. Allowance for doubtful accounts, also called the allowance for uncollectible accounts, is a contra asset account that records an estimate of the accounts receivable that will not be collected. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company's balance sheet, and is listed as a deduction immediately below the accounts receivable line item. Written by an allowance for doubtful accounts (ada) is a reduction in a company's accounts receivable. Two common contra asset accounts are allowance for uncollectible accounts receivable and accumulated depreciation. The amount of accounts receivable that a company does not expect to collect. Written by an allowance for doubtful accounts (ada) is a reduction in a company's accounts receivable. This video discusses the theory and journal entries used under the allowance method when accounting for doubtful accounts. This percentage is usually different for each age group and is estimated on the basis of past experience and current economic conditions of. Understanding the allowance for doubtful accounts. Allowance for doubtful accounts (ada). .uncollectible accounts are debited to allowance for doubtful accounts and credited to accounts receivable at the time the specific account is written establishes a percentage relationship between the amount of accounts receivable and the required balance in the allowance account. What are you talking about? This video discusses the theory and journal entries used under the allowance method when accounting for doubtful accounts. The credit balance in the allowance account is an estimate amount in an adjusting entry that debits the income statement account bad debts expense and credits allowance for doubtful accounts. Allowance for doubtful accounts primarily means creating an allowance for the estimated part of the accounts that may be uncollectible and may become bad debt and is shown as a contra asset account that reduces the gross receivables on the balance sheet to reflect the net amount that is expected to. Goodwill is recorded only at time of purchase. The allowance is established in the same accounting period as the original sale, with an offset to bad debt expense. A company charges its sales commission costs to expense. The amount you wrote off in past months for doubtful accounts is probably a good predictor of what you might write off in the future. Allowance for doubtful accounts, also called the allowance for uncollectible accounts, is a contra asset account that records an estimate of the accounts receivable that will not be collected. At the same time they debit an expense account secondly, the firm credits a contra asset account, allowance for doubtful accounts or the same amount. Two common contra asset accounts are allowance for uncollectible accounts receivable and accumulated depreciation. Accounts receivable are presented in statement ii, net of an allowance for doubtful accounts receivable, as shown in table 2. This percentage is usually different for each age group and is estimated on the basis of past experience and current economic conditions of. The allowance for doubtful accounts is a balance sheet account that reduces the reported amount ofaccounts receivable a change to the balance in you can also evaluate the reasonableness of an allowance for doubtful accounts by comparing it to the total amount of seriously overdue accounts. Say your client has $10,000 of outstanding receivables and you establish an allowance for doubtful accounts for $800, the carrying value of net receivables is $9,200. The percentage of sales method and the accounts. Two common contra asset accounts are allowance for uncollectible accounts receivable and accumulated depreciation. On the other hand, if prior misstatements of the allowance were material to the financial statements as a whole and were. The amount you wrote off in past months for doubtful accounts is probably a good predictor of what you might write off in the future. The allowance for doubtful accounts is easily managed using any current accounting software application. The ada equals the amount of those receivables that the company's management does not expect to actually collect. A company charges its sales commission costs to expense. Written by an allowance for doubtful accounts (ada) is a reduction in a company's accounts receivable. Allowance for doubtful accounts, also called the allowance for uncollectible accounts, is a contra asset account that records an estimate of the accounts receivable that will not be collected. An allowance for doubtful accounts—also known as an ada, an allowance for an allowance account is used when a company expects that some of their customers will be unable to if you offer lines of credit to your customers, establishing an allowance for doubtful accounts can improve the. Firms credit allowance for doubtful accounts, a contra asset account, to begin writing off bad debt. The allowance is established by recognizing bad debt expense on the income statement in the because the allowance for doubtful accounts is established in the same accounting period as the original sale, an entity does not know for certain. Say your client has $10,000 of outstanding receivables and you establish an allowance for doubtful accounts for $800, the carrying value of net receivables is $9,200.

An Allowance For Doubtful Accounts Is Established.: The amount you wrote off in past months for doubtful accounts is probably a good predictor of what you might write off in the future.

0 comments:

Post a Comment